Enhanced Model Term Sheet

The most comprehensive market analytics on venture deal terms

Access hundreds of data points that detail the usage and frequency of deal terms embedded in the newest model term sheet template from NVCA and Aumni.

Access hundreds of data points that detail the usage and frequency of deal terms embedded in the newest model term sheet template from NVCA and Aumni.

The National Venture Capital Association (NVCA) has partnered with Aumni, an investment analytics company, to launch the Enhanced Model Term Sheet, containing hyperlinked data points, detailing the usage and frequency of legal terms found in this model agreement.

These insights are the result of analyzing over 35,000 financing transactions, representing more than 17,000 unique investors and spanning a decade of data.

Median Fully Diluted Ownership Percent Purchased by the New Money Equity Class Across Stages

Average Fully Diluted Ownership Percent Purchased by Lead Investor Across Stages

Average Percentage of Round Purchased by Lead Investor Across Stages

Median SAFE vs Convertible Note Discount Against the New Money Price Per Share (all Stages)

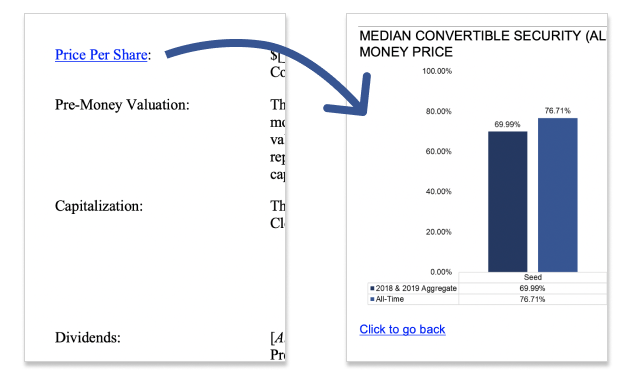

Median Convertible Security (All Types) Discount Against the New Money Price

Percentage of Equity Classes that Deviate from 1x Liquidation Preference Multiplier

Frequency of Participating Preferred Across stages

Frequency of Pay-to-Play Provision Across Stage

Frequency of Redemption Rights Across Stages

Median Lead Investor Counsel Fee Cap Across Stage

Frequency of Registration Rights Across Stages

Median Major Investor Threshold as a Percent of New Money in the Round Across Stage

Average Major Investor Threshold as a Percent of Fully Diluted Ownership Across Stages

Percentage of Equity Financings with Employee Vesting Protocol Covenant

Percentage of Equity Financings Including Drag Along Rights