Elevate your valuations

According to our Venture Beacon Report, the second half of the year saw greater capital raised by startups and at higher pre-money valuations, but does that mean you should mark up your book?

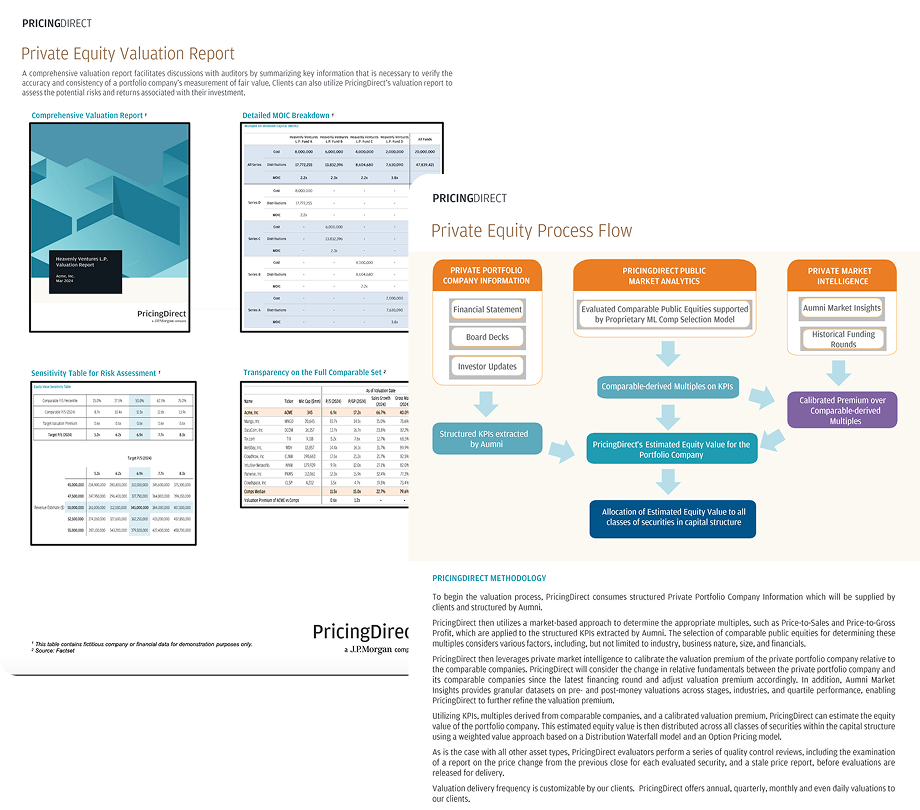

Aumni, in partnership with PricingDirect, provides private fund managers with trusted independent ASC 820 valuations, combining Aumni’s market-leading private investment structuring capabilities with PricingDirect’s decades of expertise to reduce time spent on year-end valuations.

Our Partnership

Aumni, in partnership with PricingDirect, provides private fund managers with trusted independent ASC 820 valuations, combining Aumni’s market-leading private investment structuring capabilities with PricingDirect’s decades of expertise to reduce time spent on year-end valuations.

Aumni + PricingDirect

Aumni sat down with the PricingDirect team to discuss:

- The approach behind PricingDirect’s independent valuations

- Methodologies to ensure accurate and reliable valuations

- How PricingDirect leverages Aumni’s Market Insights to ground valuations in private market trends

- The impact of regulatory compliance and evolving industry standards

Valuations simplified

Defend valuations with confidence

Independent valuations provide support and traceability for assumptions/valuation marks to auditors and LPs

Reduce time spent on periodic reporting

Take advantage of data that exists on Aumni to request independent valuations from a trusted third-party

Pair with portfolio company KPIs

Combine independent valuations with Aumni KPI Solutions to unlock greater efficiency in period-end processes

Private equity

valuation report

valuation report

See why over 3,000 clients globally use PricingDirect.

Get the Report

Find out why 350+ firms trust Aumni

Connect with an expert